top of page

Deep Dives, Not Hot Takes

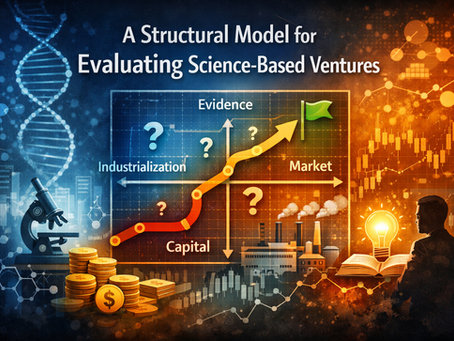

A Structural Model for Evaluating Science-Based Ventures

This article explains why intuition, pitch quality, and capital signals misclassify scientific ventures, how narrative driven evaluation creates false positives and false negatives, and why TRLs do not equal readiness. It introduces structural evaluation as a system level approach that aligns evidence, industrialization, market formation, capital logic, and uncertainty to support better decisions by investors, institutions, and venture builders.

Arise Innovations

8 min read

Traditional Business Logic Fails in Science-Based Venture Building

Science based ventures operate under fundamentally different rules. This article explains why concepts like rapid traction, early product market fit, and short iteration cycles fail in science venture building, and how applying them creates systematic decision errors. It explores the structural mismatch between business intuition and scientific reality, and outlines what science compatible evaluation and governance must look like instead.

Arise Innovations

8 min read

bottom of page